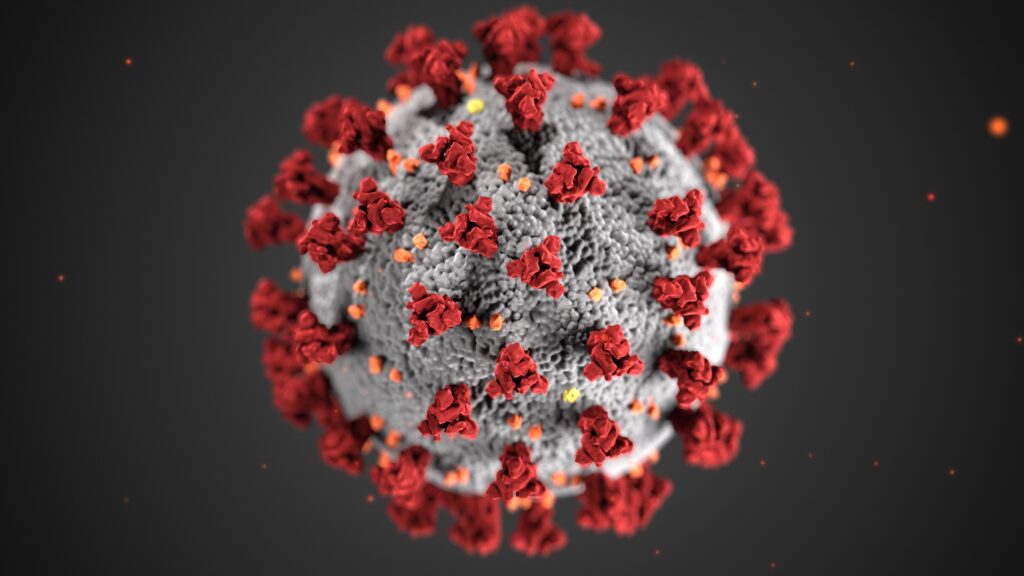

Coronavirus & Health Insurance

1st what is the coronavirus? Coronavirus is a type of virus that causes a respiratory infection in the lungs and airways. It is part of the same family as the virus, which includes the common cold. 2nd What are the symptoms? Symptoms include fever, cough, and shortness of breath, which can be mild to severe—appearing […]

Jan. 1st 2019 Small Group Rates Delayed

Small Group Rates Delayed Every year the health insurance companies of Indiana have to submit their rates and plan designs for approval through the Indiana Department of Insurance. In the past, this filing would be submitted for review and approval in the month of May. The filing for 2019 small group fully insured policies was […]

Indiana Recovers Medicaid Tax Under the ACA

Indiana was one of six states to file a lawsuit against the Affordable Care Act’s health insurance provider fee (HIPF) for State Medicaid plans. The U.S. District Judge ruled in favor of the plaintiffs, Texas, Indiana, Kansas, Louisiana, Wisconsin & Nebraska’s that the government must pay back $840 Million in Obamacare fees. What is the […]

What to Expect in 2019 for Small Group Health Insurance

All the health insurance companies that want to participate in Indiana’s small group health insurance has submitted rates & plan designs to the Indiana Department of Insurance for review. These filling are for fully insured groups with less than 50 employees. As always, it’s going to be an interesting year under the rules and regulations […]

Short Term Health Insurance Final Rule 36 months of coverage

The Trump administration released its final rule on short-term health insurance. Short-term health insurance is a policy that is very similar to pre-affordable care act coverage. The plan does not cover preexisting conditions and requires underwriting. If your accepted, the cost is 50%-60% less than an ACA product. These plans are also using traditional PPO […]

Trump Admin. Releases Final Rule on Short-Term Health Insurance

Short Term Health Insurance Final Rule 36 months of coverage Short-term health insurance is a policy that is very similar to pre-affordable care act coverage. The plan does not cover preexisting conditions and requires underwriting. If your accepted, the cost is 50%-60% less than an ACA product. These plans are also using traditional PPO networks, […]

Indiana Association Health Plans (AHPs)

The Department of Labor released their final rule on the creations of Association Health plans. There has been a great deal of criticism and misinformation in the media. The DOL final rules provide the guideline for setting up association health plans. These plans would be governed by both State and Federal guidelines. The Employee […]

2019 Individual Health Insurance for Indiana

The remaining two individual health insurance companies participating in the Indiana market have filed their rate for 2019. We now have two insurance companies offering personal health in 2019. CareSource and Celtic Insurance Company aka AM Better The good news is these two companies have decided to continue to offer individual health insurance coverage to […]

Anthem Buying Home Healthcare Aspire

Insurer Anthem Strikes Deal for Palliative Care Company Aspire Health Here is a story that was given very little media attention but is big news for Indiana’s Anthem. Anthem is buying Aspire Health that provides home healthcare services for patients suffering from serious illnesses. Aspires help patients and family manages symptoms of extreme illness to […]

Channel 13 Short Term Insurance Story

Channel 13 WTHR Investigates recently reported on a controversial story about Short-Term Health insurance and asked me to be a part of it being a health care professional. The story is about a family that had been using short-term health insurance and the woman was diagnosed with breast cancer. The policy she had purchased was […]