New Digital Insurance Cards

As we enter 2024, the health insurance and employee benefits industries are transitioning to digital ID cards. Traditional ID cards will be a thing of the past. The Insurance companies are adopting digital ID cards for several reasons, including: Cost Reduction: Producing physical ID cards involves printing, packaging, and mailing expenses. Convenience for Customers: Digital […]

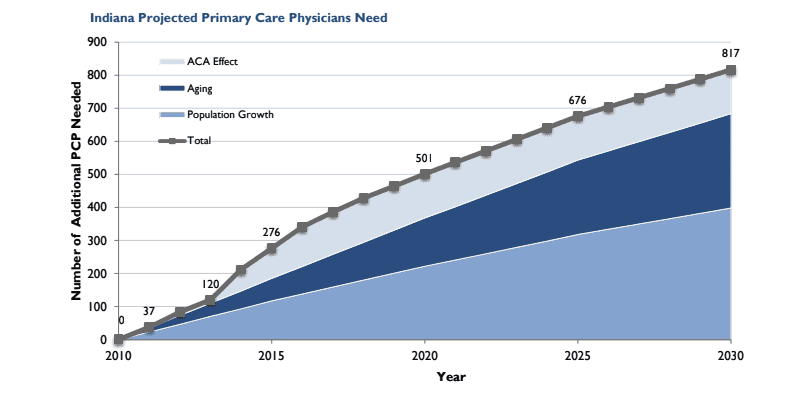

Primary Care Physician Shortages

Primary care physician shortage is a significant concern in Indiana and the entire country. The average wait for an onsite appointment with a physician is 26 days, and that is in metropolitan areas. If you live in a rural community, it could be months. Several factors contribute to this shortage of Primary Care Doctors. Aging […]

Open Enrollment for 2022 Health Insurance Coverage

Who can apply? Residents of Indiana under age 65. When can I apply? November 1, 2021, through January 15, 2021. If you experience a qualifying life event after January 15, you may still be able to apply. When does my coverage start? For those who apply from November 1, 2021, through December 15, 2021, coverage […]

Medicare Part D Creditable or non-Creditable Notices

What is the purpose of the notice? Insured employees use this information to make an informed decision on when to enroll in Part D Prescription drug coverage. Who should be notified? Employees and dependents who are eligible for Medicare and enrolled in the group-sponsored prescription drug coverage. When are the notices due? October 15, 2021 […]

Surprise Medical Billing Fix

The surprise Medical Billing fix has been included in the Covid-19 relief deal, which would protect patients from receiving large medical bills from out of network providers. The bill calls for patients to be held harmless in emergencies where they have no control over where they receive medical services, especially when it comes to ambulance […]

COVID-19 & Health Insurance

The health insurance industry has been responding as fast as they can to the treatment of COVID-19. This started as a health crisis and has now turned into a financial crisis. The health insurance industry has made multiple changes concerning COVID-19. Testing With most health insurance companies, there is not member cost for being tested […]

Coronavirus & Health Insurance

1st what is the coronavirus? Coronavirus is a type of virus that causes a respiratory infection in the lungs and airways. It is part of the same family as the virus, which includes the common cold. 2nd What are the symptoms? Symptoms include fever, cough, and shortness of breath, which can be mild to severe—appearing […]

Jan. 1st 2019 Small Group Rates Delayed

Small Group Rates Delayed Every year the health insurance companies of Indiana have to submit their rates and plan designs for approval through the Indiana Department of Insurance. In the past, this filing would be submitted for review and approval in the month of May. The filing for 2019 small group fully insured policies was […]

Indiana Recovers Medicaid Tax Under the ACA

Indiana was one of six states to file a lawsuit against the Affordable Care Act’s health insurance provider fee (HIPF) for State Medicaid plans. The U.S. District Judge ruled in favor of the plaintiffs, Texas, Indiana, Kansas, Louisiana, Wisconsin & Nebraska’s that the government must pay back $840 Million in Obamacare fees. What is the […]

What to Expect in 2019 for Small Group Health Insurance

All the health insurance companies that want to participate in Indiana’s small group health insurance has submitted rates & plan designs to the Indiana Department of Insurance for review. These filling are for fully insured groups with less than 50 employees. As always, it’s going to be an interesting year under the rules and regulations […]