2021 Indiana Individual Health Insurance

Every year the insurance companies participating in the Indiana Individual Health Insurance market must submit their rates and plan designs to the Indiana Department of Insurance for approval. Any Hoosier who has had to purchase health insurance in the Indiana Individual Health Insurance market know that we have only a few carriers offering coverage in the […]

Health Reimbursement Arrangements (HRA) and Individual Health Coverage 2

If you work or own a small business, you may be familiar with using HRA’s to help reimburse employees for individual health insurance. This strategy has been around for over a decade and has always been controversial under the tax code. Small businesses that have struggled with group health insurance costs and participation requirements have […]

Are you looking for COVID-19 testing?

Indiana residents seeking COVID-testing can find testing locations by visiting www.coronavirus.in.gov. The Indiana State Dept of Health has partnered with OptumServ to provide testing to anyone seeking a test across Indiana. You will need to register before testing at https://lhi.care/covidtesting or call 888-634-1116. How much will the test cost? Nothing. What if I receive a […]

Premium Credits To Employer Insurance Plans

With shelter-in-place orders across the country, there has been a considerable drop off in medical services as result insurance companies are returning some of the premiums to employers in the form of credits. Each carrier is taking a different approach: On health plans- an employer could receive anywhere from 5%- 15% credit based on a […]

Time to review the Insurance Benefits and Processes?

With the economic shutdown from COVID-19, is this a time review insurance benefits and processes? Every business is different, and COVID has impacted every industry, which may lead some employers to re-address their benefits and procedures. Process & Procedures: Employee education on Insurance Benefits has been changing the last five years, to a more digital […]

COVID-19 & Health Insurance

The health insurance industry has been responding as fast as they can to the treatment of COVID-19. This started as a health crisis and has now turned into a financial crisis. The health insurance industry has made multiple changes concerning COVID-19. Testing With most health insurance companies, there is not member cost for being tested […]

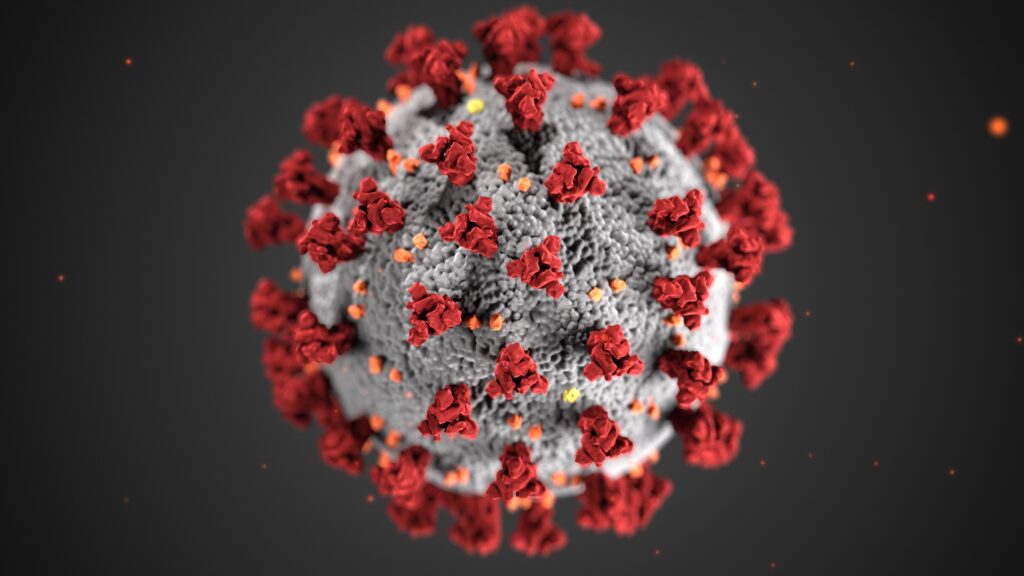

Coronavirus & Health Insurance

1st what is the coronavirus? Coronavirus is a type of virus that causes a respiratory infection in the lungs and airways. It is part of the same family as the virus, which includes the common cold. 2nd What are the symptoms? Symptoms include fever, cough, and shortness of breath, which can be mild to severe—appearing […]

Early Retirement and Health Insurance

One question we field almost on a weekly basis is: “What is health insurance going to cost if I retire before 65?” Under the Affordable Care Act, it is not an easy question to answer because everyone’s situation is different. When trying to budget for individual health insurance it’s important what time of year you […]

Health Insurance & Presidential Elections

The Kaiser Family Foundation (KFF) is an organization that researches a variety of health care topics. They just released a quiz on health issues with the presidential election standpoint. It’s a brilliant way to test your knowledge of the politicians and their views on health care. With health care being one of the tops of […]

Individual Health Insurance 2020

This is Nefouse & Associate’s sixth open enrollment since the affordable care act has gone into effect. We are one of the last Indiana based agencies to still be active in the individual market. There has been a lot of changes, but one thing has stayed the same, costs continue to rise. We have just […]