As We Approach 2018, How is Health Insurance of Indiana Looking?

Group Health Insurance Indiana We quickly approach Jan 1st, 2018, the state of health insurance in Indiana is nowhere near close to being stable. Individual Health Insurance The Affordable Care Act has failed every Hoosier that pays for or towards a health insurance policy. One segment of the population has benefited from the ACA, and […]

Did the ACA Effect Group Health Insurance?

Group Health Insurance Indiana When the Affordable Care Act (ACA) went active, a large a majority of Indiana small business dropped their group health plans and moved to the individual market. At first, this was an excellent option for reducing costs for both the company and the employee. Businesses that had little employee turnover, no […]

Group Health Insurance Participation

Group Health Insurance Insurance companies in both Indiana and the rest of country have always enforced participation requirements. Small groups (under 50 employees) and “Large” groups (50+ employees) have had to have at least 50% of the full time employees elect coverage. Insurance companies do vary on employee participation. Group Health Insurance for Small Groups […]

Federated Leaves the Group Health Market

Indiana Health Insurance Company Updates Recently, it was announced that Federated is leaving the group health market. They are exiting the state of Indiana and the rest of the country. They will end providing group health, life & disability on Dec. 31st of 2017. “Federated does not see an end to the uncertainty surrounding the […]

IU Health Plans Exit Individual Market

Group Health Insurance Indianapolis – IU Health Updates At the end of June, IU announced that they were leaving the individual market. There announcement was very quiet and received almost no media attention. IU Health Plan is owned/an extension of Indiana University Health. The medical group has had insurance products available in Indiana. They offer […]

Indiana Group Health Insurance for New Companies

When a startup company launches, one of the last issues that is addressed is Group Health Insurance & employee benefits. The founders of the startup company, may have years of experience in their industry or are on the cutting edge of new technology. When it comes to Indiana Group Health Insurance, leadership may lack experience. […]

Anthem Individual Exit Indiana

Anthem announced that they would exit in the Indiana individual market in 2018. They are pulling all on exchange plans and will offer one off exchange plan in five counties. (Benton, Newton, White, Jasper & Warren) It is estimated that Anthem insures 46,000 Hoosiers on the exchange and about 20,000 off exchange. This decision to […]

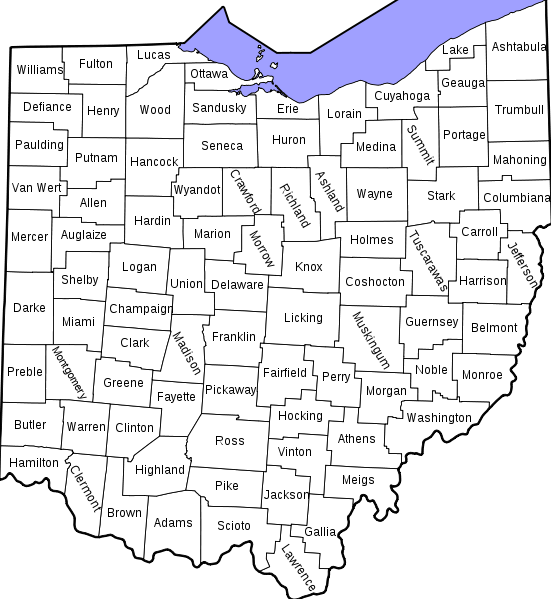

Anthem Individual Exits the Buckeye State

As of June 6th, Anthem announced they are exiting the Ohio individual exchange market. They are going to offer just one off exchange plan and that will be in Pike County. Pike County, Ohio, has a population of less than 30,000, so this is really a complete exit from Ohio. Anthem was one of the […]

Small Business Health (SHOP) Options Ends

CMS announced on May 15th that they would end the Small Business Health Options (SHOP) program, effectively on November 15th 2017. The SHOP program allowed small business to purchase group health insurance through the Federal Facilitated Exchange. The goal, was to allow small business to offer multiple plan design and received a tax credit for […]

American Health Care Act Bill Passes the House

Our Indiana Health Insurance Company Talks about the American Health Care Act Bill A lot of commentators, journalists & health care experts are voicing their views on the American Health Care Act. The reality is, the changes the senate are going to make will determine the true impact to health coverage. The supporters of the […]