Navigating The Death of an Employee

Managing grief in any setting is a profoundly personal experience that doesn’t follow a set timeline or pattern. As an owner/HR/manager, supporting your team through a loss can be challenging but crucial for maintaining a healthy and compassionate work environment. Here’s a comprehensive guide on what to expect and how to navigate the grieving process […]

Filing Medical Insurance Claims

The medical claims submission processed has changed over the years with technology but the steps to ensure your claim is processed accurately and promptly have not. Here’s a guide on how to fill medical insurance claims: Understand Your Policy: Familiarize yourself with your health insurance policy to understand what is covered, exclusions, and any copayments, […]

Nefouse & Associates Scope of Services

As a benefit consultant we advise businesses on designing, implementing, and managing employee benefits packages. These benefits can include health, dental, vision, life, disability insurance, and other perks that contribute to employees’ overall compensation and well-being. 1.) Needs Analysis: Assessment: Understanding the unique needs and demographics of the client’s workforce. 2.) Plan Design: Customization: Designing […]

2023 Indiana General Assembly- Health Insurance Impacts

The 2023 Indiana General Assembly has wrapped up its Legislative session, and we will have new laws that impact Indiana’s fully insured health insurance. HEA 1004- Healthcare Matters This bill addresses Indiana skyrocketing healthcare costs. The original version required non-profit hospitals to report healthcare charges and would fine any costs exceeding 260% of what Medicare […]

Healthcare Matters House Bill No 1004

Rep. Donna Schaibley introduced House Bill No. 1004 Beginning in 2025, nonprofit hospitals must submit, on average, how much they charge for each healthcare service they provide. Should a nonprofit hospital charge more than 260% of the Medicare reimbursement rate, it could be assessed a penalty. The penalty paid would be applied to fund the […]

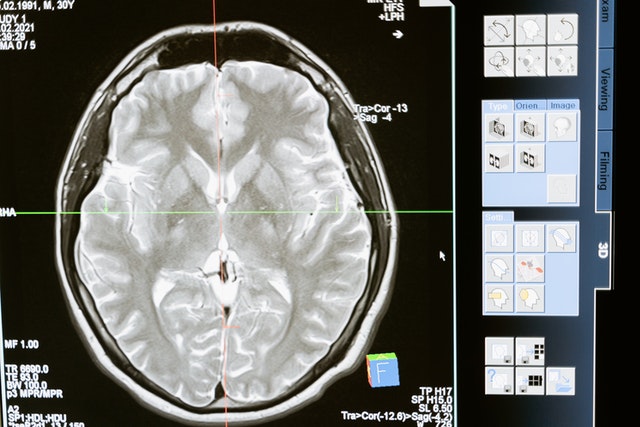

Indiana Medicaid Redetermination Process

The Families First Coronavirus Act (FFCRA) mandated continuous Medicaid enrollment through the federal COVID-19 public health emergency. The continuous enrollment suspended the redetermination process by prohibiting any cancelation of coverage. Now that the public health emergency has been lifted, all Medicaid recipients must complete a redetermination to determine if they remain eligible. On the national level, […]

Employee Assistance Programs (EAP)

The month of May was mental health awareness, and there was an increase in interest in Employee Assistance Programs, not just in Indiana but the entire nation. What is an Employee Assistance Program (EAP)? An employee benefits program is a benefit a company will provide to their employees to help address personal and work-related issues […]

Do Different States Mean Different Costs?

Youth sports play a massive role in many parents’ lives. We are constantly shuffling kids from practice, private coaching, games, training, and tryouts. We all hope our children will not need medical attention, but there is a high probability you will find it throughout a youth sports career. This is the story of my kids […]

Elimination of the Family Glitch?

The current administration intends to fix the “family glitch” under the Affordable Care Act (ACA). Under the ACA, an employee may be eligible for a premium tax credit if the employer-sponsored group health plan costs more than 9% of the employee’s income. The “family glitch” disqualified employees dependent from receiving tax credits even if the […]

Small-Group Health Insurance & Inflation

We are now starting to experience the impact of inflation on all industries. The cost of doing business is going up for most industries. Inflation can be devasting on small businesses and force owners to make difficult decisions. One benefit is that small businesses can make changes quickly. When it comes to Indiana Insurance Benefits, […]