President Biden officially signed into law H.R 1319 aka American Rescue Plan Act of 2021 on March 11, 2021. One of the goals of the law is to expand Health Insurance by making it more affordable.

Marketplace Tax Credits Expansion on Health Insurance

Under the new law, people that purchase individual and family Health Insurance through the federal marketplace could see their monthly premiums drop.

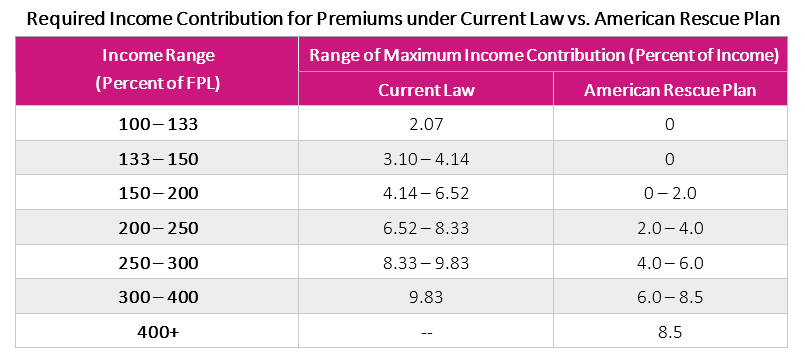

Currently to be eligible for the tax credit aka premiums assistance household income has to be under 400% of the federal poverty level. Under the new law, the 400% requirement is being lifted. It’s not clear what the income cap is going to be or if there is going to be an income cap.

Currently, those that qualify for premium assistance pay no more than 9.83% of their household income towards premiums. Now qualify subsidies recipients will not pay more than 8.5% towards Health Insurance premiums. Those making less than 400% of the FPL could pay as low as 2% of their income for the Individual health insurance policy.

If there is indeed no cap in household income for premium assistance, we could see a huge migration to the individual market. Small groups with less than 20 employees could see participation drop off.

COBRA

Under H.R. 1319 the government will fully subsidize 100% of COBRA premiums for those employees that were laid off, furloughed, or had a reduction in hours. This should allow any employee that qualifies to continue the group health to keep that coverage in place with no cost to them. In fact, the subsidized cobra premium may be lower than what they were contributing as a full-time employee. Employees that leave employee voluntarily are not eligible for the premium assistance. This benefit will expire in September of 2021.

The American Rescue Plan is going to have a huge impact on the individual Health Insurance markets. We will see a large portion of individuals that have purchased a short-term, med share, & indemnity policies return to the exchanges because now they will qualify for premium assistance.

Small employers with less than 10 employees that are offering group health plans may be forced to drop coverage because of participation issues.

As always, Nefouse & Associates is in a position to provide our client with the best Health Insurance options.