One of the points of the Affordable Care Act was to increase choices for insurance, both for small groups and individuals. That’s been the case, to a certain extent, but it’s worked out better in some situations that others.

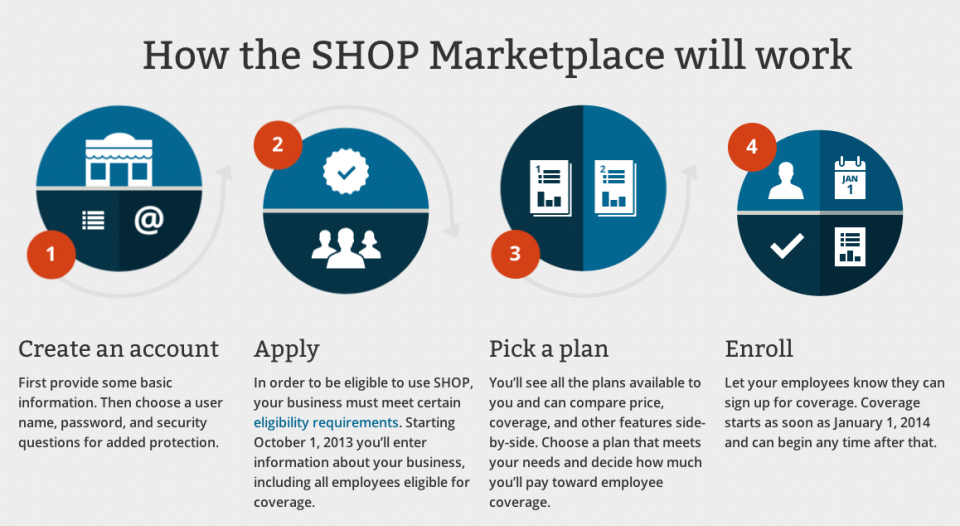

Under the ACA, the exchange is suppose to offer small-group health insurance choices. These plans would have tax credits for the small group employer. The tax credits are on a sliding scale depending on number of employees and average income. These choices are called the SHOP program, for Small Business Health Options.

The federal-facilitated exchange for Indianapolis will have the option of multiple-plan elections for small group employees — Indianapolis has no state-run exchange. Some other states that have state-based exchanges have been able to opt out of offering multiple plans for small groups.

There are many reason why a state exchange may opt out of that option. The first one is the technology to offer multiple plans and what it would cost to integrate that technology with the carriers. The carriers may have the same issue.

SHOP is supposed to give small businesses more choice in the marketplace.

In Indianapolis we will have the multiple-choice option for small groups on the exchange, but here is the reality. If your employees wages are so low that your small business qualifies for the 50%-of-contribution tax credit, you may be better off dropping your group plan. Move the employees to the exchange and allow them to pick up personal tax credits. They would end up in a better situation, unless you are willing to pay the entire premium for the employee and his or her spouse and dependents.

One recent SHOP article on Politico points out that only a small fraction of small businesses have signed up for SHOP thus far. One hurdle right now is that online enrollment is not yet available, but should be by fall — no consolation for businesses that don’t want to apply on paper.

The bottom line is that SHOP needs to be revamped. There has to be more incentives for small groups to go that route.

In the meantime, your business can always contact Nefouse & Associates or call us at (800) 846-8615 about your small business insurance options in today’s post-ACA world.