New Employer Leverage for Indiana Group Health Insurance Costs

Whether you have five employees or 5,000, every employer has felt the pressure of rising Indiana Group Health Insurance costs. But now you have a new advantage with House Enrolled Act 1004, a state law that empowers you to demand transparency, control costs, and renegotiate what you’re paying for healthcare. At Nefouse & Associates, we […]

Drug Prices Under the Microscope—How Federal Pressure Could Impact Indiana Group Health Insurance

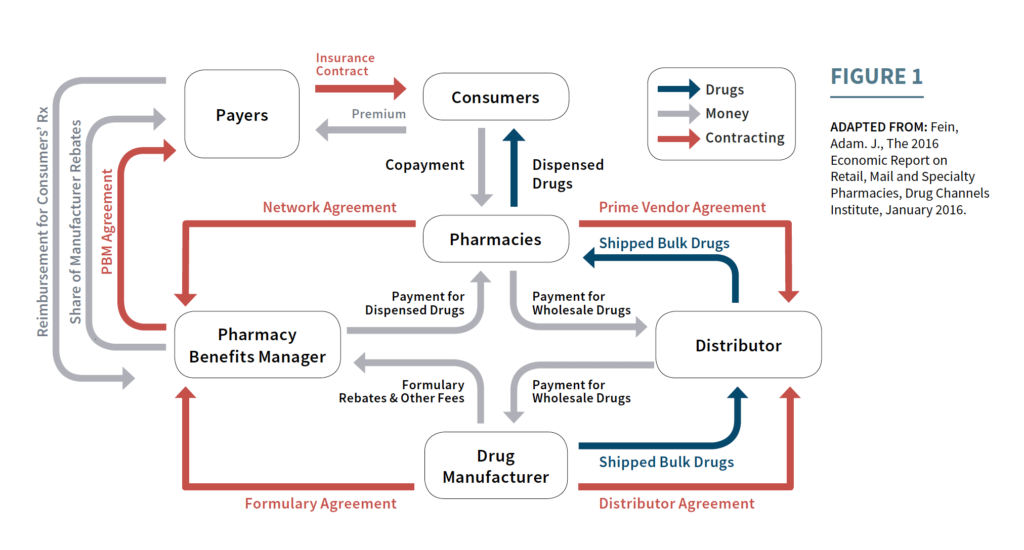

The federal government has launched a major effort to bring down the cost of prescription drugs in the United States. The newly announced executive order takes aim at the price gap between what Americans pay for medications and what those same drugs cost in other developed nations. As a health benefits consultant working across Indiana, […]

2025 Drug Copays

One of the health insurance trends we see across all carriers is the increased cost of drug copays. Almost every plane has moved to a Tier 2 Copay of $50. For the last decade, tier 2 has averaged around $35-$40. When you look into health insurance, you’ll quickly realize that prescription drug tiers matter. Drug […]

Executive Order to Reveal Health Care Pricing

On 6/24/19, the President of the United States issues an executive order requiring Hospitals and Insurance companies to reveal what they are charging or paying for services. The idea is to make health care cost transparent, which then would lead to consumerism and then medical providers reducing costs to attract more patients. Primarily pressuring the […]

The Trumps Administration Blueprint to Lower Drug Prices

The Trump administration released the American Patient First which is a guide to lower drug prices. The blueprint provides two phases; Phase 1 is actions the President can take to lower prices, Phase 2 is for HHS actions of consideration and solicit feedback. The blueprint is looking at four areas to address, Increased Competition, Better […]