It’s common knowledge that offering health insurance benefits helps attract and retain great employees, yet businesses are looking for ways to cut costs as benefits get more expensive. Have you ever considered a self-funded insurance plan?

It’s common knowledge that offering health insurance benefits helps attract and retain great employees, yet businesses are looking for ways to cut costs as benefits get more expensive. Have you ever considered a self-funded insurance plan?

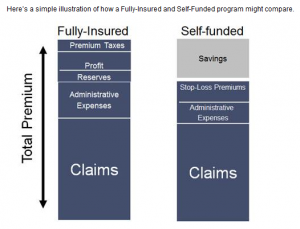

In a self-funded plan, a business can provide health benefits directly to employees. Instead of the insurance companies, the employer collects the premiums, assumes the risk and pays employee claims. Feel like that might be too much work? Insurance companies can still execute the administrative aspects for your company.

But what if the company underestimates its employees’ claims and can’t afford to pay them? There are reinsurance contracts that have low stop-loss limits. Stop-loss insurance is just what it sounds like: stop the losses. This is a limit on the amount that a policyholder must make in coinsurance and out-of-pocket payments per year on an insurance policy. Generally, the stop-loss limit is stated as a flat dollar amount. Once the stop-loss limit has been reached, the health insurance company picks up all remaining expenses for the year. With a low stop-loss contract, a self-funded plan may be more of an option than what it has been in the past.

Below is a check list of what PPACA provisions will directly impact self-funded plans.If you are a group that has a self-funded plan or is entertaining a self-funded plan, these are the some of the provisions that must be covered. Once we see the full impact of the ACA on the fully-insured market, we may see that self-funded plans become an option for both small and mid-sized companies.

- Prohibition on Lifetime Benefit Limit

- Extension of Dependent Coverage to age 26

- Restrictions on annual dollar limits for Essential Benefits

- Medical FSA’s must limit reimbursements of over the counter products

- Prohibition on cost-sharing for Preventive Services

- Establishment of internal and external appeals process

- Coverage for emergency services at an in-network cost-sharing level with no prior authorization required

- Reporting on W-2’s of aggregate cost of employer sponsored coverage

- Increase on HSA tax distribution for non-qualified medical expenses from 10% to 20%

- Women’s Preventive Care expansion according to US Preventive Services Task Force

- Quality of Care Reporting

- Provide Summary of Benefits document

- Medical Flexible Spending Plans limited election of $2,500

- Notice of Exchanges

- Eliminate tax deduction for employers taking the Medicare Part D subsidy for retirement prescription drug coverage

- Comparative effectiveness research fees

- Clinical trial coverage must be provided

- Cost-sharing limitation for qualified high deductible health plans

- Elimination of eligibility rules

- Elimination of all pre-existing exclusion clauses

- Reduce any eligibility waiting period to no more than 90 days

- Employer mandate to offer coverage (delayed to 2015)

- Reporting on minimum essential coverage to IRS

- Reinsurance Contribution

- Automatic Enrollment (delayed until regulations are published)